The simplest way to save and grow your wealth

Use the ‘round up’ strategy which involves automatically rounding up your transaction to the nearest $1 or amount of your choice each time you make a purchase and allocating the difference to a nominated savings account.

This allows you to automate your savings seamlessly with little or no impact on you. It may not seem like a lot, but the key here is the long-term compounding of this feature. This function can complement an existing savings strategy but also act as forced savings for those who are not so good in this area.

The first step would be to check with your financial institution to see if they offer this facility, but if not, have a look at a couple of options outlined below or try a simple google search.

1. ING Every day Transaction Account

If you have an ING account, which you may have been referred to by Scott Pape, in the ‘barefoot investor’, setting this up is extremely simple.

- Log into your ING online account from your PC, MAC or web browser on your phone (not through the app) – https://www.ing.com.au/securebanking/

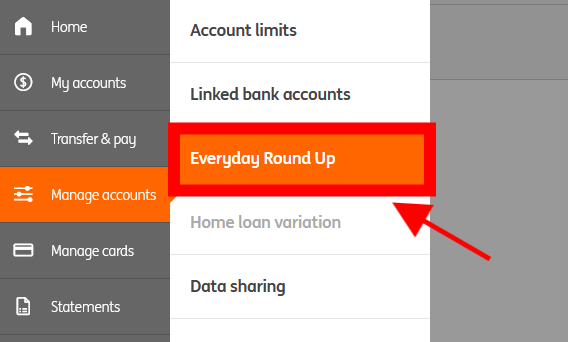

- Select the ‘Manage accounts’ option from the left-hand menu followed by ‘Everyday Round Up.

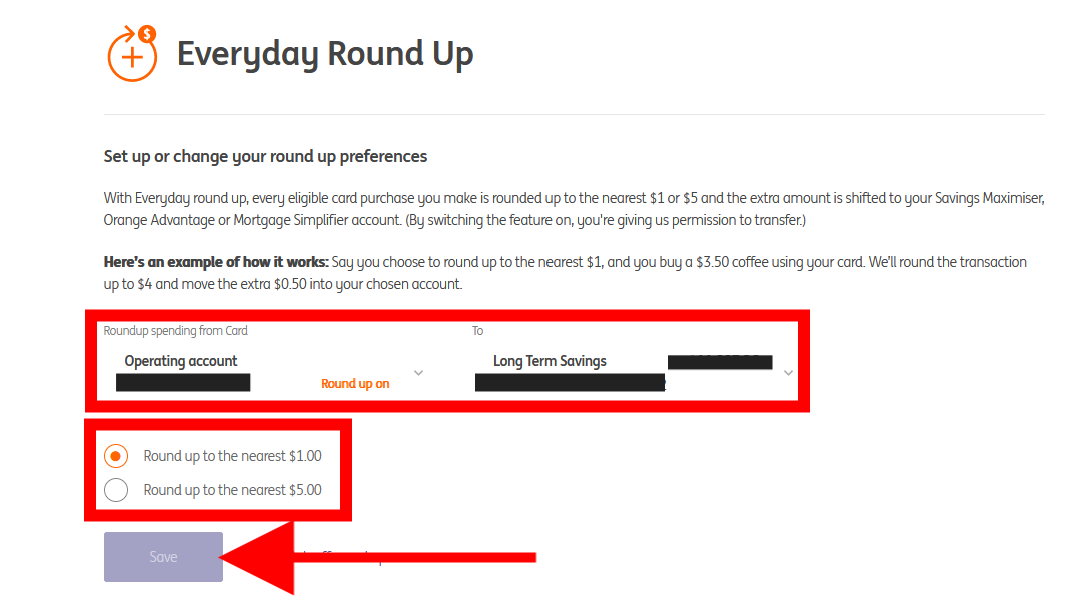

- Select the account you use for the majority of your spending, in this case, the ‘Operating account’. From here, select the account you want the rounding adjustments to be transferred to i.e. ‘Long Term Savings’. From here simply select the amount of rounding adjustment that you want, i.e. to the nearest $1 or $5. Obviously the higher it is, the more you will save, but if you are looking for an unnoticeable amount to start with, the $1 amount will work wonders. For example, if you spend $10.60, the function will round this up to $11.00 and transfer the $0.40 into your savings account automatically. Once you selected the rounding amount, simply hit the ‘save’ button and you are all set to go.

If you don’t have an ING account, you can apply for a free ‘feeless’ account (providing you meet their criteria) directly through their website. This can all be done seamlessly online and you can have an account live in under 10min (from experience) – https://www.ing.com.au/everyday-banking.html

2. Alternative options

You can set up some free accounts through up.com.au, which appears to have been established with a big emphasis on this feature – https://up.com.au/features/round-ups/ (currently on 9th April 2022). This would work in a similar way to above where you create an operating account (spend the majority of your funds through), followed by a savings account to allocate the rounding adjustments too.

There could be some other nice perks through this provider but have a read through their terms and conditions before proceeding.

Another option is to do a simple google search for ’round up savings’ and sure you will be spoilt for choice with other providers offering this service.

To conclude, if you want to automate your savings in a way that will have minimal impact on your day-to-day life, the ’round up’ function is a perfect solution. This is perfect for high volume transactions accounts and the compounding nature of your savings. If you are wanting to save large amounts then consider rounding up to the highest amount possible as well as any other strategies you would like to put in place.

Note that we do not receive any commissions from any of the above links and provide general advice only. Please consider your own personal circumstances before deciding.